about

Art Vantage PCC Limited

Our objective is to bring a level of transparency and professionalism that will enable a broader range of investors to diversify into art investments.

.jpg)

We believe art is a suitable investment for individuals, family offices, private banks, hedge funds, private equity firms, pension funds, insurance companies, banks and family foundations. Our aim is to provide such investors with an opportunity to improve their overall investment portfolios via exposure to art.

Classical portfolio theory recommends an allocation of 3-10% to art given the asset class's history of low correlation to other asset classes and strong returns, depending on the investor's risk profile. This is particularly appropriate for investors that have little or no exposure to art, or exposure to other parts of the art market. As a focused sub asset class with unique characteristics, Contemporary art in Emerging Markets is also a sensible addition for many established art collectors that lack the expertise and exposure to this high growth area.

Via Art Vantage PCC Limited, owner of the Tiroche DeLeon Collection, the founders have combined their experience in private banking, venture capital and art investments to create a truly innovative art fund. One that is based on macro-economic fundamentals and a strong return profile, but simultaneously takes it's social responsibility to heart and seeks to benefit the artists, the art industry, art institutions and the general public. Our model is also unique in that it is built on a strong curatorial foundation as well as an optimized structure for investors, combining the best contemporary thinking in both finance and art, in a harmonic symbiosis.

We travel to local markets in the developing countries to conduct extensive research and eventually acquire works from galleries representing the most talented artists. Through dialogue with gallery directors and curators, and occasionally the artists themselves, we identify the most suitable works for our collection. Our transparency, globality, visibility and size, enhance our appeal and make us an attractive collection for artists to be part of, ultimately providing us with preferential access and pricing. The founders are the first investors in the fund and will be the last to redeem their shares.

Art as an Asset Class

Art is an independent asset class. Historically, art has demonstrated very low correlation to other asset classes such as stocks, bonds, cash, hedge funds, real estate and private equity. Furthermore, according to leading research in the field, the overall performance of the art market, calculated using repeat sales in the past 50 years of auction history was circa 8.8% per annum. This exceeded all other asset classes with the exception of equities, which returned circa 9.2% per annum.

Why Contemporary Art?

Contemporary art is the fastest growing segment of the circa US$60 billion per annum global art market, but also the most volatile. It has the greatest potential for market outperformance, but professional guidance is the key to successful investment in this area. When the right selections are made price appreciation can be exceptional. Contrary to the myth that artists' works appreciate mostly after death, artists usually appreciate the most during their lifetime.

Particularly, we believe that works made during the last two decades in emerging markets, with the underpinnings of an era of significant social flux, are the most likely to appeal to the current generation of new wealth. Locally established artists in emerging economies, yet to gain international recognition, present the greatest opportunity.

Why Emerging Markets?

It has become apparent in the past decade that developing markets are the new growth engines of the world economy. As the wealth of consumers in these markets increases, in tandem with cultural infrastructure investments, demand for art should grow substantially (see Maslow's Hierarchy of Needs below). This is a key investment premise for the Tiroche DeLeon Collection. We also believe that there is currently an unjustifiably large pricing gap between artists of similar stature in developing markets and developed markets. We are of the view that this gap should close over time, just as levels of education, income and cultural infrastructure are closing.

Research has demonstrated that the strongest returns in art have been achieved in works priced under $100'000. In the developing markets it is much easier to acquire works of the highest quality within that price range. The average acquisition price of the Tiroche DeLeon Collection is circa $60'000, right at the statistical sweet spot of the art market.

Why Invest through a Fund?

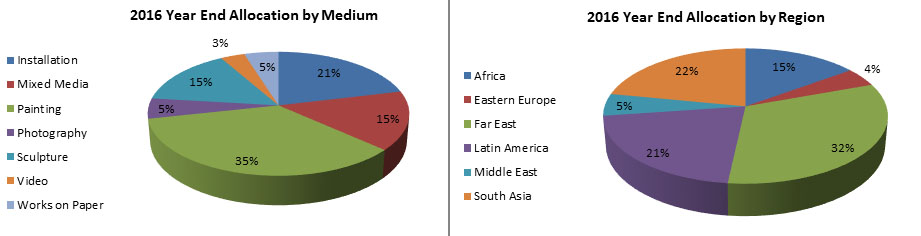

- Funds provide diversification and economies of scale by pooling assets to gain greater exposure across the art world. Diversification across geographies and mediums are essential to avoid concentration risks. Economies of scale allow for assembly of research and operational expertise, management skills, as well as buying and selling power.

- Having a robust infrastructure is essential in order to support the acquisition of large scale works and a global lending program. In turn, museum exposure for artworks in the collection enhance the value of these works, creates visibility for the collection and eventually builds the Tiroche DeLeon brand, which in itself enhances the value of every work in the collection. A virtuous circle.

- Corporate governance and a regulated structure protect investors from potential conflicts of interest, as well as providing tax efficiency and regular accounting and reporting.

- A clearly defined investment strategy, with proper risk management and exit strategy.

- Independence and objectivity of the service providers of the fund, and related segregation of duties.

- Combining social responsibility, intellectual rigor, education and lifestyle enhancement for interested investors

- Eligible investors have the possibility to borrow or acquire works from the collection.

Summary of Terms

- Currency: US$

- Minimum investment: US$500,000

- Management Fee: 2%

- Performance Fee: 20%, subject to high watermark.

- Subscription fee (payable to 3rd party distribution agents): tiered fee up to 3% depending on level of subscription to the Fund.

- Redemption fee: Nil

- All other operating costs including but not limited to professional service providers fees and costs, transportation, shipping and storage will not exceed 1.5% of the Fund’s net asset value.

- Investment in specie: investors may contribute artworks to the fund subject to full due diligence and acceptance of such by Art Vantage.

- Lock up: until February 28, 2017 (during the period of investment).

- Redemptions: during the holding and consolidation period (years 6 to 8) on a semiannual basis with redemption gates of 5% of NAV and a 90 day notice period. All other redemptions will occur during the run-off period (years 9 and 10).

- Redemption in specie: Upon mutual agreement Art Vantage may elect to meet redemption requests with artworks, based on the latest valuation.

- Term: 10 years (5 years period of investment, 3 years holding and consolidation period and 2 years run off period).

The fund detailed on this website is for experienced investors only, as defined by the Financial Services (Experienced Investor Funds) Regulations 2012.

- Quarterly Factsheet - Q4 2019 »

- Quarterly Factsheet - Q2 2019 »

- Quarterly Factsheet - Q1 2019 »

- Quarterly Factsheet - Q4 2018 »

- Quarterly Factsheet - Q3 2018 »

- Quarterly Factsheet - Q2 2018 »

- Quarterly Factsheet - Q1 2018 »

- Quarterly Factsheet - Q4 2017 »

- Quarterly Factsheet - Q3 2017 »

- Quarterly Factsheet - Q2 2017 »

- Quarterly Factsheet - Q1 2017 »

- Quarterly Factsheet - Q4 2016 »

- Quarterly Factsheet - Q3 2016 »

- Quarterly Factsheet - Q2 2016 »

- Quarterly Factsheet - Q1 2016 »

- Quarterly Factsheet – Q4 2015 »

- Quarterly Factsheet – Q3 2015 »

- Quarterly Factsheet – Q2 2015 »

- Quarterly Factsheet – Q1 2015 »

- Quarterly Factsheet – Q4 2014 »

- Quarterly Factsheet – Q3 2014 »

- Quarterly Factsheet – Q2 2014 »

- Quarterly Factsheet – Q1 2014 »

- Quarterly Factsheet – Q4 2013 »

- Quarterly Factsheet – Q3 2013 »

- Quarterly Factsheet – Q2 2013 »

- Audited Financial Statements 31 December 2018 »

- Audited Financial Statements 31 December 2017 »

- Audited Financial Statements 31 December 2016 »

- Audited Financial Statements 31 December 2015 »

- Audited Financial Statements 31 December 2014 »

- Audited Financial Statements 31 December 2013 »

- Audited Financial Statements 31 December 2012 »

- Audited Financial Statements 31 December 2011 »

- Subscription Pack »

- Private Information Memorandum May 2019 »

- TDC Brochure - March 2012 »

Request password