Manager Update – Q4 2014

15.01.2015—

Judging by the fall auctions this quarter, the art market appears to continue its Northern trajectory. But are we really 'under heaven'?

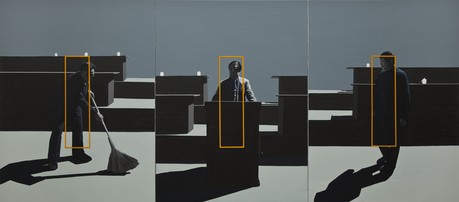

Xu Zhen, 'Under Heaven', 2014 (detail)

Xu Zhen, 'Under Heaven', 2014 (detail)

War in the middle-east, an economic meltdown in Russia/Ukraine, turmoil in the global energy markets, a correction in equities, signs of first economic tightening in the US, growing recessionary fears in Europe, slower growth in the developing economies… all brushed aside by an appetite for master works that seems to grow by the day. ![]()

Auctions

On one hand, the auction market continues to set new records for the Post-War & Contemporary category. The October sales in London set the tone for the massive New York sales the following month. Christie’s again eclipsed Sotheby’s, breaking new turnover records in both locations. The London auction week achieved GBP 129 Million at Christie’s compared with a mere GBP 40 Million at Sotheby’s. In New York, the Christie’s evening sale set a new all-time auction record for a single sale when it achieved an astounding $745 Million, bringing the Christie’s sale week to $879 Million in total. Sotheby’s also had a good week in New York with a total tally of $550 Million. Many auction records were set – 11 at the Christie’s evening sale alone – but none of the works got close to Bacon’s “3 studies of Lucien Freud” which continues to hold the title for the most expensive artwork sold at auction, $142 Million, by a wide margin.

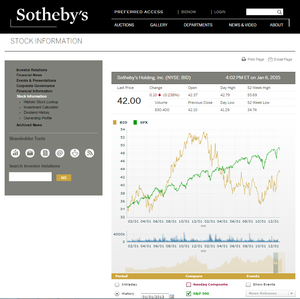

But on the other hand, and despite these very strong results, both auction houses have been undergoing a major shake-up at the senior executive level. William Ruprecht, CEO of Sotheby’s, stepped down at the end of November. Only 12 days later, on December 2nd, it was the turn of Christie’s CEO Steven Murphy to make room for Patricia Barbizet, a long-time executive in Francois Pinault’s empire, who took over the helm at Christie’s. Sotheby’s are still on the look-out for a new CEO.

But on the other hand, and despite these very strong results, both auction houses have been undergoing a major shake-up at the senior executive level. William Ruprecht, CEO of Sotheby’s, stepped down at the end of November. Only 12 days later, on December 2nd, it was the turn of Christie’s CEO Steven Murphy to make room for Patricia Barbizet, a long-time executive in Francois Pinault’s empire, who took over the helm at Christie’s. Sotheby’s are still on the look-out for a new CEO.

Among several other reasons, such as activist shareholders and internal politics, it appears that in both houses expenses are growing even faster than revenues and margins are shrinking. Competition for the best works is getting fiercer. Auction houses must sweeten the deals for sellers by spending more on marketing, providing higher guarantees or going as far as giving up part of the buyer premium (see article). This creates a dilemma for shareholders. On the one hand turnovers are spiraling upwards at a pace that seems unsustainable, while on the other – profitability is shrinking and business risk is rising. So they must be thinking “if we don’t make money now, when will we?”. So they opt to cut costs at the top and hope that new leadership is more prone to drive change in their flagging business models, perhaps via greater focus on developing the online business or through faster expansion in new markets – aka China and India for starters.

Among several other reasons, such as activist shareholders and internal politics, it appears that in both houses expenses are growing even faster than revenues and margins are shrinking. Competition for the best works is getting fiercer. Auction houses must sweeten the deals for sellers by spending more on marketing, providing higher guarantees or going as far as giving up part of the buyer premium (see article). This creates a dilemma for shareholders. On the one hand turnovers are spiraling upwards at a pace that seems unsustainable, while on the other – profitability is shrinking and business risk is rising. So they must be thinking “if we don’t make money now, when will we?”. So they opt to cut costs at the top and hope that new leadership is more prone to drive change in their flagging business models, perhaps via greater focus on developing the online business or through faster expansion in new markets – aka China and India for starters.

Stock markets have responded with a roar. The overall Skate’s Art Stock Index (SASI), which we use as one of our performance benchmarks in our fact-sheets, was down circa 26% in 2014. Sotheby’s, which is still a 40% constituent of SASI, mitigated losses for the index by declining by “only” 18.8% in 2014. Check the news item for more details.

Art Fairs

In the major Art Fairs, I attended Frieze, FIAC and Art Basel Miami this quarter, sentiment continues to be buoyant, but somehow this appears to be the norm now. Similar to the auction market however, one feels a growing disparity between the major fairs and the satellite fairs. The overlap seems to get smaller and smaller and the difference in quality / median prices bigger and bigger, as if there are two parallel contemporary art markets that have little in common.

Fund Update Wang Jianwei, '...the event matured, accomplished in sight of all non-existent human outcomes.No.28', 2013

Wang Jianwei, '...the event matured, accomplished in sight of all non-existent human outcomes.No.28', 2013

During the quarter we made numerous acquisitions, the most significant of which were in China – an important large scale canvas by Liu Xiaodong (see spotlight) and 3 works by Wang Jianwei whose major solo exhibition “Time Temple” is ongoing at the Guggenheim Museum in New York – until February 16. We also acquired 2 additional works by Xu Zhen to complement the existing 4.

Xu Zhen, 'Under Heaven', 2014, 'Play', 2014

Xu Zhen, 'Under Heaven', 2014, 'Play', 2014

We also made 2 very profitable sales this quarter. At Sotheby’s evening sale in London our El Anatsui “They saw us through puffs of smoke” sold for close to $1 million, producing a net IRR of 60%. At Christie’s NY day sale we sold the first work by Adrian Villar Rojas ever to appear at auction, for $87’500. We acquired the work in mid-2011, long before Adrian achieved his well-deserved status as an art world superstar. We achieved an impressive net internal rate of return of 72% for the period. We continue to own four other significant works by Adrian as we believe his market will continue to grow from strength to strength.

We also made 2 very profitable sales this quarter. At Sotheby’s evening sale in London our El Anatsui “They saw us through puffs of smoke” sold for close to $1 million, producing a net IRR of 60%. At Christie’s NY day sale we sold the first work by Adrian Villar Rojas ever to appear at auction, for $87’500. We acquired the work in mid-2011, long before Adrian achieved his well-deserved status as an art world superstar. We achieved an impressive net internal rate of return of 72% for the period. We continue to own four other significant works by Adrian as we believe his market will continue to grow from strength to strength.

On the fundraising side, I travelled with Filipe da Costa Leite, our director of Business Development, to Portugal for a few investor meetings in October. This resulted in a couple of new investors who joined us during the quarter. Filipe also lectured on our behalf in Milan on Oct 22nd at Open Care, in a course organized by Tools for Culture, while I gave a talk in Israel in an event we organized jointly with a Real Estate fund on November 11. These talks help position us as leaders and innovators in the industry. We also learned during the quarter that our model is broadly used as an example of best practice in various publications, and most notably at Sotheby’s Institute courses.

On the fundraising side, I travelled with Filipe da Costa Leite, our director of Business Development, to Portugal for a few investor meetings in October. This resulted in a couple of new investors who joined us during the quarter. Filipe also lectured on our behalf in Milan on Oct 22nd at Open Care, in a course organized by Tools for Culture, while I gave a talk in Israel in an event we organized jointly with a Real Estate fund on November 11. These talks help position us as leaders and innovators in the industry. We also learned during the quarter that our model is broadly used as an example of best practice in various publications, and most notably at Sotheby’s Institute courses.

The Quarter Ahead

The first quarter of 2015 looks quite busy once again. In January I will travel to Singapore for Art Stage. In February probably Cape Town for the art fair followed by Madrid for Arco. March starts with a 2 day visit to the NMAC foundation in Cadiz, a 1 day stop-over in Gibraltar for our annual board meeting, and later in the month back to Asia for Art Basel Hong Kong and possibly some gallery meetings and studio visits in mainland China.

I hope you had a remarkable 2014, a memorable Christmas and a celebratory New Year. May 2015 prove even better! I am always eager for your feedback and look forward to your comments, thoughts and questions.

Best wishes,

Serge Tiroche

news archive

Manager Update - Q4 2015

Dec. 31, 2015—A quarterly update by Serge Tiroche about the state of the art market and activites of the Tiroche DeLeon Collection.

Read More »Artist Spotlight: Paulo Nazareth

Dec. 31, 2013—How a Masterpiece from the Tiroche DeLeon Collection elevated the Brazil based artist who travels the world, Paulo Nazareth

Read More »Map Feature

June 1, 2013—We are proud to incorporate a new feature to our website:

View the collection on Map