Manager Update - Q3 2015

04.10.2015—

Markets recover from China’s “Black Monday” scare

Art Market

August 25th sent jitters through financial markets around the world. The Shanghai composite lost 8.5% in a day and sent global markets spiraling down. The Dow Jones lost over 1000 points at the open and ended down ‘only’ 588 points, the worst day in 4 years.

The art market was immediately concerned. With Chinese buyers playing an increasingly important role and the local Chinese art market already somewhat cooler, fears were mounting. I was immediately interviewed by Plus 24 – Il sole 24 Ore in Italy (see full interview transcript in English here). My opinion was, and remains, that unless the Chinese correction sustains for extended periods and the Chinese economy suffers a hard landing, the impact on art markets will be negligible, and possibly even positive.

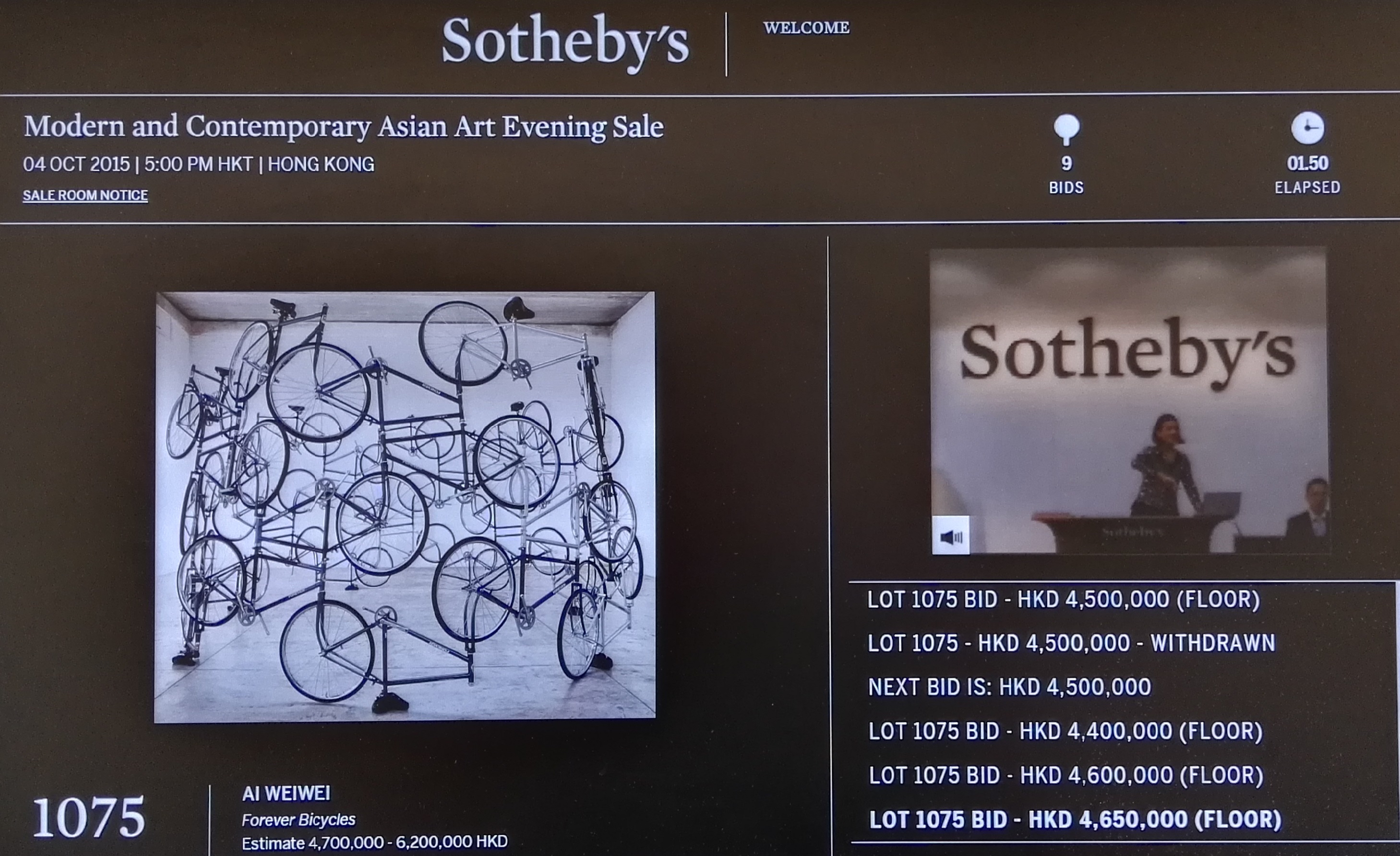

Fast forward 6 weeks to October 4th, while I am writing this, it appears western markets have settled down after a circa 10% correction and are starting to move up again. The Contemporary Art market major league season opened today with Sotheby’s HK evening sale, where results are strong, particularly for Modern works and a few exceptional contemporary pieces such as a 1960 Kusama that set a new world record of just above $ 7 million.

(Side Note: Today, a very eloquent and intelligent analysis of what I have been feeling intuitively for many years was published by Marion Maneker. It explains why blue-chip art has become the new reserve currency of the ultra-wealthy and sheds new light on the robust underpinnings of the art market. Find the link in the newsletter, it’s a must read.)

Art Vantage Fund Update

The results of this auction for the Tiroche DeLeon Collection are mixed however. While there were strong results for several artists we collect such as Ronald Ventura, Nyoman Masriadi, Jigger Cruz, Geraldine Javier, Wang Xingwei and Liu Wei; there was a substantial counter effect from the poor result achieved for Ai Weiwei’s “Forever 2003”, which sold for $730’000 to a single buyer.

Another edition of this work is in our collection. We acquired our version in 2011 for 545’000 Euro. Since then Weiwei’s career has seen remarkable progress resulting in this work being valued consistently higher by 4 consecutive external valuations (3 auction houses and a leading art advisory firm): $1.5 million in 2011, $1.6 in 2012, $1.8 in 2013 and $2.2 in 2014. But now that there is a definitive benchmark price for the work we must assume the next external valuation on Dec 31, 2015 will result in a sharply lower value for this work. We will therefore be taking a large revaluation reserve which will be reflected in the fund’s October NAV. We believe this poor auction result is due to a misjudgment by the seller who decided to place a large scale institutional work for sale via the auction market, which is primarily geared to private collectors and dealers. The choice of HK as location is also questionable as Weiwei’s market is still primarily in Europe and the US. We are of the view that the real value of this work is substantially higher and this will present an excellent opportunity for new investors seeking to join the fund as we will certainly hold on to ours for the long term.

Another edition of this work is in our collection. We acquired our version in 2011 for 545’000 Euro. Since then Weiwei’s career has seen remarkable progress resulting in this work being valued consistently higher by 4 consecutive external valuations (3 auction houses and a leading art advisory firm): $1.5 million in 2011, $1.6 in 2012, $1.8 in 2013 and $2.2 in 2014. But now that there is a definitive benchmark price for the work we must assume the next external valuation on Dec 31, 2015 will result in a sharply lower value for this work. We will therefore be taking a large revaluation reserve which will be reflected in the fund’s October NAV. We believe this poor auction result is due to a misjudgment by the seller who decided to place a large scale institutional work for sale via the auction market, which is primarily geared to private collectors and dealers. The choice of HK as location is also questionable as Weiwei’s market is still primarily in Europe and the US. We are of the view that the real value of this work is substantially higher and this will present an excellent opportunity for new investors seeking to join the fund as we will certainly hold on to ours for the long term.

In other fund news, we sold 2 works this quarter. A Suboth Gupta work was sold back to the gallery at the same price it was acquired. We feel Gupta’s market is suffering from illiquidity in the overall Indian contemporary art market and we have another work by him we intend to hold on to. Furthermore, we had opportunities to reinvest the proceeds in new artists we feel must be part of our collection and hold greater investment potential. A good example of that is the acquisition of a rare early sculpture from 1995 by Africa’s leading contemporary artist, El Anatsui. In September, we also sold our YZ Kami via Phillips, setting a new world auction record of $161’000 for the artist. We acquired the work at auction exactly 4 years ago at Christie’s NY where we paid $68’500, representing a respectable net IRR of %18.

In other fund news, we sold 2 works this quarter. A Suboth Gupta work was sold back to the gallery at the same price it was acquired. We feel Gupta’s market is suffering from illiquidity in the overall Indian contemporary art market and we have another work by him we intend to hold on to. Furthermore, we had opportunities to reinvest the proceeds in new artists we feel must be part of our collection and hold greater investment potential. A good example of that is the acquisition of a rare early sculpture from 1995 by Africa’s leading contemporary artist, El Anatsui. In September, we also sold our YZ Kami via Phillips, setting a new world auction record of $161’000 for the artist. We acquired the work at auction exactly 4 years ago at Christie’s NY where we paid $68’500, representing a respectable net IRR of %18.

Tiroche DeLeon Collection Updates

Another piece of excellent news is that we have finally found the right opportunity to hold a major exhibition of works from our Latin American Collection. Curated by art historian, collector, book editor, philanthropist, Tate and Serpentine patron and Gasworks chairwoman Catherine Petitgas, the exhibition will be held in Mana Contemporary’s new space in Miami’s Wynwood district with an opening planned during Art Basel Miami. The intention is to travel the exhibition to further destinations.

On September 9th, we concluded our second residency project for South African artist Isabelle Grobler with the opening of an exhibition titled 'the cannibal’s congress'. Timed to coincide with the opening of START’s new gallery and office space in Jaffa, it was held in an adjacent space and was extremely well attended and received much acclaim for the local art community. Isabelle is currently in the UK preparing her exhibition that opens at Sulger-Buel Gallery in London on November 5th. Residency #3 for Cui Jie from China, in collaboration with Leo Xu Projects, is currently underway with initial works looking very promising. More on this in the next newsletter.

The summer held its fair share of travels. I started with Venice for the Biennale where it was very gratifying to see 21 artists in our collection participating and our Lavar Munroe's work selected by Okwui Enwezor for the main exhibition “All the World’s Futures”. I also spent a week in Ibiza celebrating co-founder Russ DeLeon’s unforgettable 50th party, “50 shades of orange and blue” and a week in Denmark and Norway with my 16 year-old son, where we got to visit the incredible Louisiana and Astrup Fearnley Museums.

Next I travel to London for the auctions, Frieze and 1:54 African art fair, and then Paris for FIAC and Asia Now, a new Asian focused art fair which promises to be very interesting. Africa and Asia continue to be areas of focus for us as interest in these markets grows steadily around the world with strong demand from private collectors, institutions and auction houses alike.

I look forward to seeing you on the circuit and welcome your thoughts and comments as always.

Best wishes,

Serge Tiroche

Co-founder

news archive

Tiroche DeLeon Collection - 2015 Performance

April 14, 2016—2015 Collection Performance, Contribution Analysis & Portfolio Allocation.

Read More »Recent Exhibitions - Q2 2015

July 13, 2015—Works from the collection exhibited during Q2 2015.

Read More »Manager Update - Q1 2016

April 14, 2016—A quarterly update by Serge Tiroche about the state of the art market and activites of the Tiroche DeLeon Collection

Read More »