Manager Update - Q1 2015

07.04.2015—

Dear Friends,

This quarter I travelled to Singapore, London, Cape Town, Madrid, Cadiz, Gibraltar and Hong Kong to seek new acquisitions for the collection, develop our new artist Residency program which launches in earnest in April (read news item), to complete the 2014 year end valuation and to participate in our annual Board meeting.

Adeline Ooi (Director of Art Basel Hong Kong) and Serge Tiroche at Yavuz Gallery booth, March 2015

Adeline Ooi (Director of Art Basel Hong Kong) and Serge Tiroche at Yavuz Gallery booth, March 2015

I am pleased that all trips have been fruitful. We added numerous works to the collection and made one sale of a large sculpture by Shirazeh Houshiary, setting a new auction record for a sculpture by the artist.

The art market continues to be strong, especially in the Post War and Contemporary sectors, which have been buoyed further by very strong sales at the top end of the market, especially in the US. Various market reports released this quarter confirm that the market continues to expand. The very comprehensive Tefaf Art Market Report for 2014 concluded that the market increased 7% YOY to 51 Billion euros, setting a new all-time record. In terms of breakdown by art markets, Tefaf estimates the US accounted for 39% versus 22% for each of China and the UK. Interestingly however, the Arptprice 2014 Art Market report, which this year was prepared in collaboration with Artron Art Group of China, focuses on the auction market only and paints a slightly different picture, whereby global volume increased by 26% in 2014 to $15.2 Billion. China retained top market share with 37.2%, followed by the US at 32.1% and the UK at 18.9%. Auction turnovers in 2014 increased markedly in the US and the UK whereas the China auction market contracted by 5%, with the Contemporary sector declining the most, by 14% .

The 2014 valuation of our collection was broadly in line with our book values, with certain regions performing better than others. See a detailed analysis of our 2014 results here. Our overall net annual return to investors for the year stood at 4.99%, beating returns for all major asset classes with the exception of Real Estate. Our analysis demonstrates again the importance of diversification between regions as some (Far East) have substantially outperformed others (Eastern Europe, Latam).

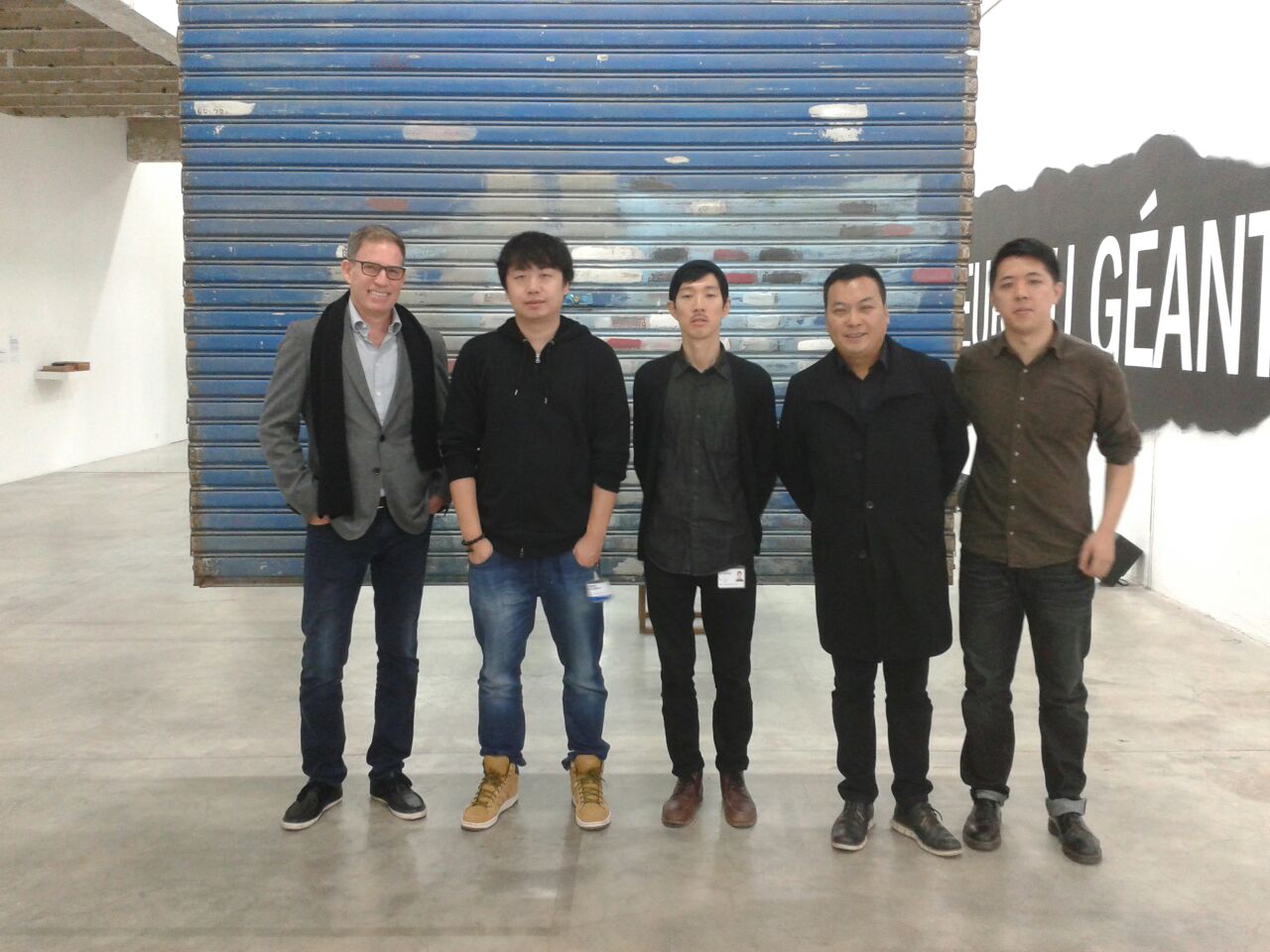

Serge Tiroche, Wu Hao, Joey Tang, Qu Kejie and Billy Tang at "Inside China" exhibition, Palais de Tokyo, October 2014

Serge Tiroche, Wu Hao, Joey Tang, Qu Kejie and Billy Tang at "Inside China" exhibition, Palais de Tokyo, October 2014

Our loan program expanded to new venues – many across Asia. Following a visit in October to the Palais de Tokyo in Paris where I saw the exhibition “Inside China”, met with curator Joey Tang and artist Wu Hao and his gallery Magician Space, we acquired 3 gates by Wu Hao, 4 sculptures by Yu Ji and 2 paintings by Li Gang. Several of these works continued to a second venue at the K11 Foundation in Hong Kong, where they are currently on display. From there, they travel on to the K11 Foundation in Shanghai. Our large Los Carpinteros installation went on view at Parasol Unit in London at end of March and will be on view through end of May. Our Yinka Shonibare “Crash Willy” will continue to travel in Korea, from the SeMA in Seoul to the Daegu National Museum where it opens in May. Our large William Kentridge drawing “Anti-Entropy” will also travel to several destinations in Asia - The UCCA in Beijing from June 2015, MMCA in Seoul from Dec 2015, and to the Sifang Museum in Nanjing.To see full list of recent exhibitions during Q1, click here.

Some changes in our team. Daniel Lev-Er, who has been our COO & collection manager, is moving on to become the COO of ArtRunners, a new venture we are backing in the art logistics field. Yoad Bar Noy, who joins us from ZK Gallery in San Francisco, will take over all of Daniel’s responsibilities. In addition, Andrea Levin, who has been interning with us for the past 3 months, joins us as research and content assistant. Please join me in wishing them much success in their new roles.

news archive

Tiroche DeLeon & Valentino Collaboration

Feb. 22, 2017—Valentino Haute Couture Spring/Summer Fashion show features works from the Tiroche DeLeon Collection

Read More »Manager Update - Q3 2019

Oct. 26, 2019—A quarterly update by Serge Tiroche about the state of the art market and activities of the Tiroche DeLeon Collection.

Read More »Artist Spotlight: Shilpa Gupta

Jan. 22, 2020—We are proud to dedicate this artist spotlight to Shilpa Gupta.

Read More »