Manager Update - Q2 2015

29.06.2015—

The Market

"The ultra-rich scrabbled to find good investments in a world of plummeting interest rates, where art is a haven” wrote Anne-Hélène Decaux on June 23rd, summarizing the Art Basel week for ArtViatic. And indeed the art market is booming. Most galleries at the fair boasted very strong sales and re-hung their booths several times during the week. In parallel, auction results exceed expectations regularly, all over the globe. Consumption of Art is at its highest, the investment buzz is strong and there are no signs of slowing down… yet.

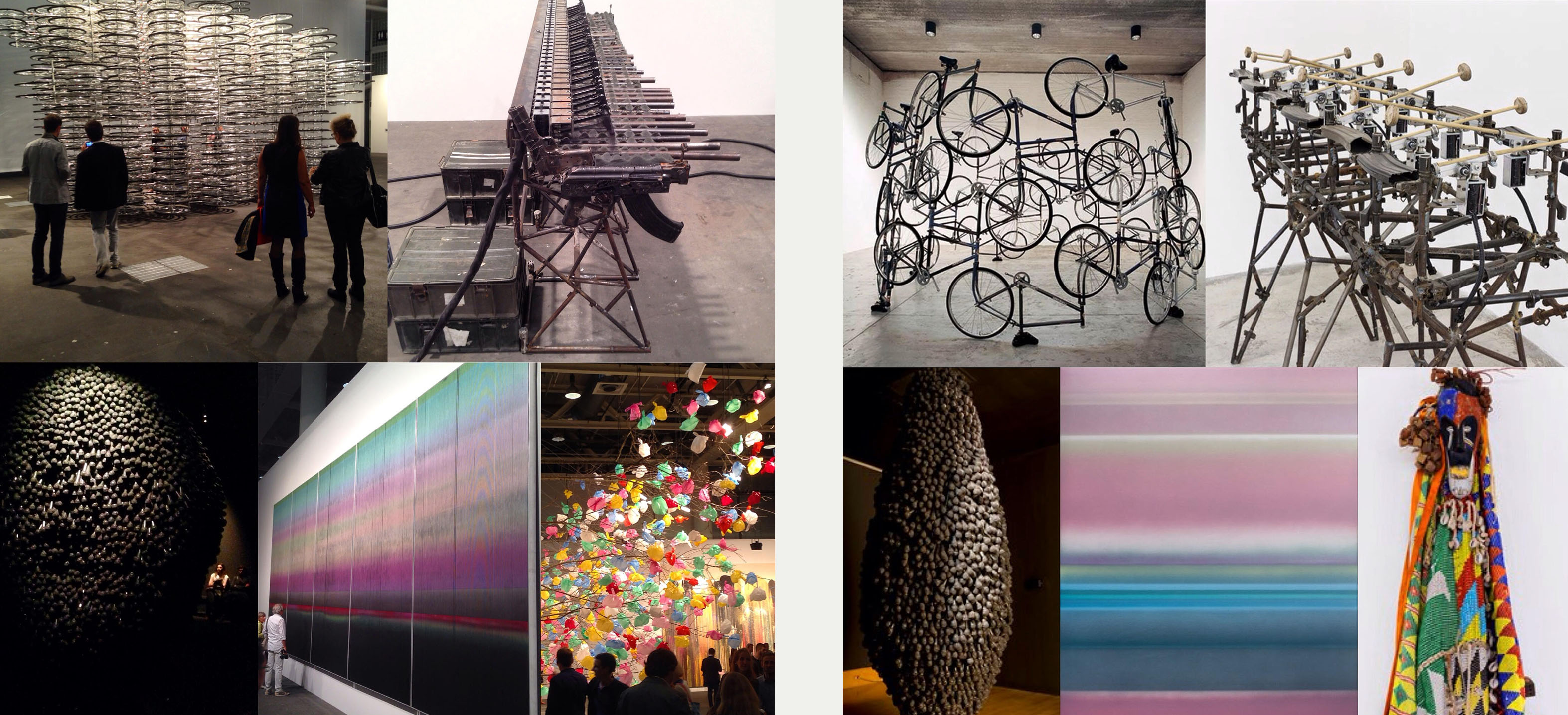

Left: Works in Art Basel "Unlimited" 2015. Right: Works acquired by the Tiroche DeLeon Collection in 2011-2014.

Clockwise: Ai Weiwei, Pedro Reyes, Shilpa Gupta, Liu Wei, Pascale Marthine Tayou

Venture Capital takes notice of art market growth

Investments in the field continue to grow, particularly in the online space where new models for art e-commerce, art news and information, collection management and other tools are abounding, and raising phenomenal amounts of capital. Some new models are even going public. Read our related updates on the Skate’s Art Stock Index as well as the Hiscox Online Art Trade Report.

We too are now participating selectively. After being skeptical in the past several years about the multitude of e-commerce models and the unpredictability of the winning one (I was approached by many such ventures), I recently flew to China to hold discussions with such a venture about possible synergies with Art Vantage. I believe that the market has matured somewhat and that particularly the Chinese market is more amenable to purchasing art online. In addition, we have decided to back a new start-up in the overlooked art logistics sector - ArtRunners - which emanated from our own frustrations with the inefficiencies of acquiring art logistics services around the world. The company's mission is to transform the way these services are acquired by creating a global community supported by strong technological infrastructure and efficient communication via an online marketplace. The company is currently finalizing its business plan and will set-out to raise capital during Q3-Q4.

Fund Activity

Within the Tiroche DeLeon Collection we are fully invested and have therefore slowed our pace of acquisitions, focusing instead on our recently launched Residency program. The program is a new model that allows us to add works of the highest quality to the collection, whilst providing the younger artists we support a unique opportunity to expand their horizons culturally, artistically and spiritually.Our first artist, Ruben Pang can already be hailed a success with queries for acquiring his works coming over Instagram even before the exhibition opened on July 1 and receiving good media coverage. We are in advanced talks with artists from China, Argentina, Brazil and South Africa for Q4 2015 and Q1 2016 Residencies. Interestingly, many of the acquisitions this quarter have been of Singapore artists, a buoyant scene: Ruben Pang, Sookoon Ang, Genevieve Chua and Robert Zhao Renhui.

That said, we did make several acquisitions this quarter after visiting Art15 and Photo London in May, a trip to China in June and then at Art Basel. In Beijing I saw the four simultaneous gallery exhibitions that Ai Weiwei opened. This was the first time the artist has had solo exhibitions in the mainland and I believe this is a significantly positive development for his market and hence for the fund. I did an extensive gallery tour and met with Philip Tinari, Director of the UCCA, who took me around the museum during the mounting of the new exhibitions of He Xiangyu and William Kentridge, to which we lent our large drawing “Anti-Entropy”. We made 1 sale this quarter of a work by Vik Muniz which resulted in a 30% profit after almost 2 years, a respectable 15% gross IRR.

On the left, Serge Tiroche with Bin He, CEO of Hihey.com. On the right, selfie with Ai Weiwei, taken by the artist.

On the left, Serge Tiroche with Bin He, CEO of Hihey.com. On the right, selfie with Ai Weiwei, taken by the artist.

In June, I was invited by the American University of Paris, of which I am a graduate, to give a talk to Alumni who came for the school’s 50th anniversary. For the occasion we prepared an 8-minute documentary about my background and current activities - watch it here. Filipe Costa Leite joined me in Paris to present the fund and was soon after interviewed by Larry's List about his reasons for joining the Tiroche DeLeon Collection. We used the time in Paris to meet with several local supporters of our activity including advisory board members Dominique & Sylvain Levy, owners of the incredible DSL Collection, in their Paris home. We also held talks about a sponsorship and advertising campaign, more about this in the next newsletter.

From the left: Pierre Naquin - founder of AMA, Serge Tiroche, Sylvain Levy of the DSL Collection and Filipe Costa Leite

From the left: Pierre Naquin - founder of AMA, Serge Tiroche, Sylvain Levy of the DSL Collection and Filipe Costa Leite

Art Basel was a whirlwind of exhibition openings, private viewings, art fair frenzy and nonstop dinners, drinking events and dancing parties. However, we did manage to do some business. A particularly encouraging validation of our selections for the fund was in the Unlimited section this year. See the two images at the top of my update comparing the Unlimited selections of 2015 with the more reasonably sized works we acquired for the Tiroche DeLeon Collection in the past 4 years. Foresight or luck?… judge for yourself.

Best wishes for a sunny, relaxing summer,

Serge Tiroche

news archive

Manager Update - Q3 2013

Oct. 1, 2013—A quarterly update by Serge Tiroche about the state of the art market and activites of the Tiroche DeLeon Collection

Read More »Manager Update - Q2 2018

July 3, 2018—A quarterly update by Serge Tiroche about the state of the art market and activities of the Tiroche DeLeon Collection.

Read More »Tiroche DeLeon & Valentino Collaboration

Feb. 22, 2017—Valentino Haute Couture Spring/Summer Fashion show features works from the Tiroche DeLeon Collection

Read More »